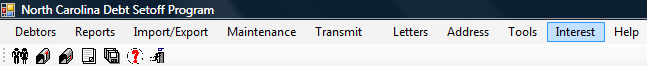

- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

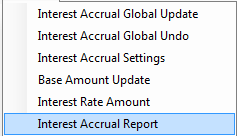

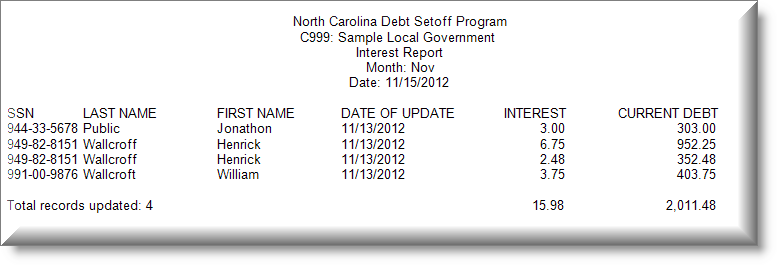

The Interest Accrual Report - is an optional report that provides a list of the debtors that had interest accrual processed via the Interest Accrual Global Update. The report will only print if the Interest Accrual Global Update has been processed for the desire month.

Only account codes/departments that were configured as Interest Accruable. These are most probably only TAX and/or VTAX.

Frequency: This process can be run at anytime, but is recommended immediately following the Interest Accrual Global Update.

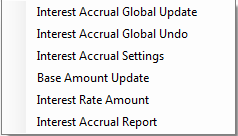

- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

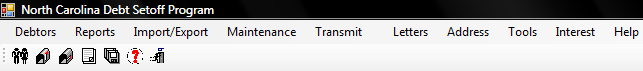

1. From the Main Menu click Interest:

2. The Interest menu options:

3. Move the mouse over Interest Accrual Report and click this option:

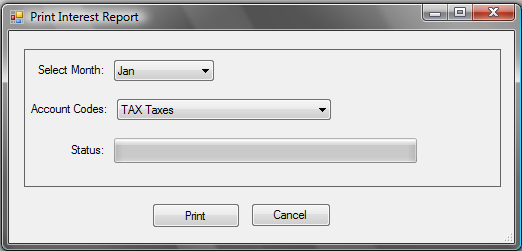

4. A dialog screen appears with the Account Code(s) configured as Interest Accruable in the Tools-Administrator-Account Codes, Configure setting:

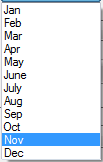

and select the desired Month.

and select the desired Month.

- can go back as far as eleven months. The Interest Accrual Report information begins to overwrite after twelve months.

- can go back as far as eleven months. The Interest Accrual Report information begins to overwrite after twelve months.

- Click

to abort and return back to the main menu

- Click

to update to permanently remove all debts $0.00

Sample Interest Report - for November

This report uses the Print Preview options:

- terminates the view of the report and returns to the Main Menu:

- terminates the view of the report and returns to the Main Menu: